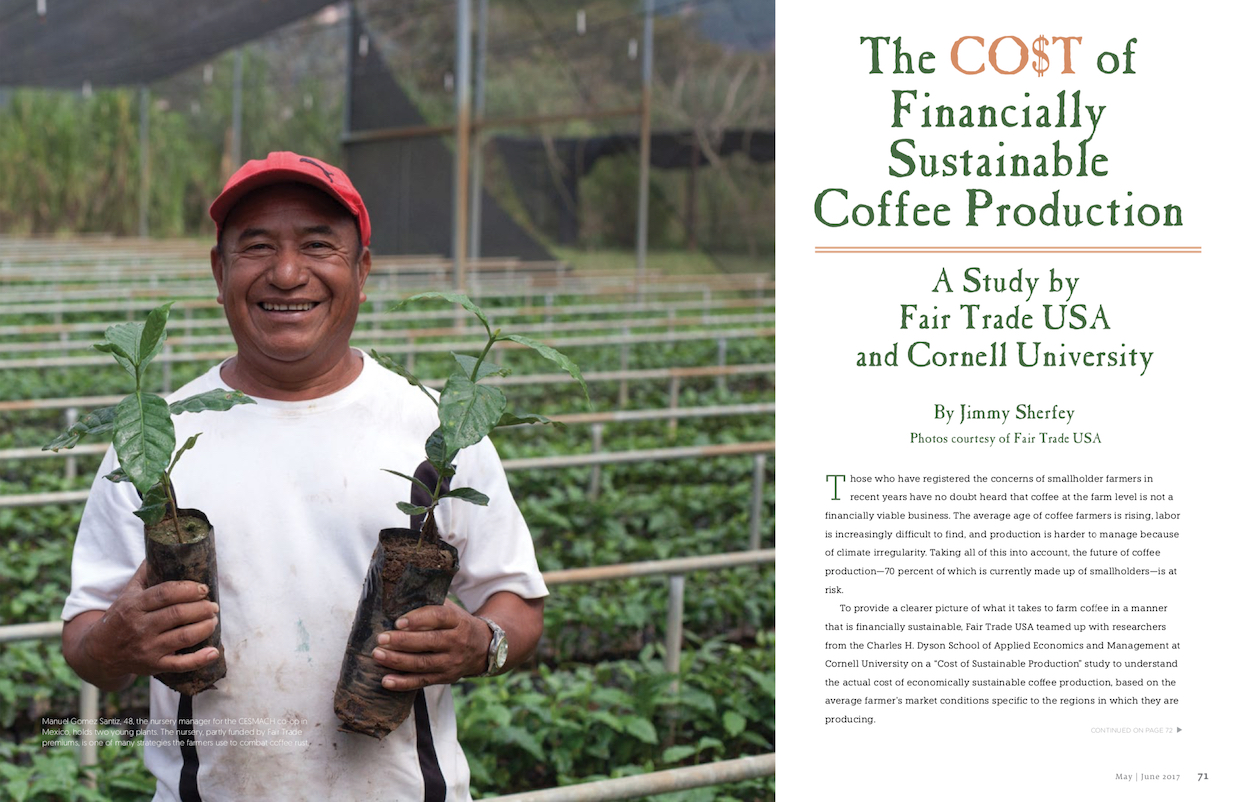

Manuel Gomez Santiz, 48, the nursery manager for the CESMACH co-op in Mexico, holds two young plants. The nursery, partly funded by Fair Trade premiums, is one of many strategies the farmers use to combat coffee rust.

(Editor’s note: This article written by Jimmy Sherfey originally appeared in the May/June 2017 issue of Roast magazine. Photos courtesy of Fair Trade USA. Links have been added for context.)

Those who have registered the concerns of smallholder farmers in recent years have no doubt heard that coffee at the farm level is not a financially viable business. The average age of coffee farmers is rising, labor is increasingly difficult to find, and production is harder to manage because of climate irregularity. Taking all of this into account, the future of coffee production — 70 percent of which is currently made up of smallholders — is at risk.

To provide a clearer picture of what it takes to farm coffee in a manner that is financially sustainable, Fair Trade USA teamed up with researchers from the Charles H. Dyson School of Applied Economics and Management at Cornell University on a “Cost of Sustainable Production” study to understand the actual cost of economically sustainable coffee production, based on the average farmer’s market conditions specific to the regions in which they are producing.

Cornell University economist Juan Nicolas Hernandez-Aguilera interviews members of the ADISA co-op in Peru.

The Study Basics

In summer 2015, the Cornell team joined Fair Trade USA for the first round of data collection in Honduras and Peru. In an agricultural landscape made up of independent smallholder producers of varying sizes and levels of sophistication, precise data collection is currently impossible. Researchers, led by Juan Nicolas Hernandez-Aguilera, an applied economics Ph.D. candidate at Cornell, did the next best thing: They sat down to speak with farmers organized under the same cooperatives. Over the course of the next year and a half, researchers conducted comprehensive interviews with hundreds of farmers from four producer organizations partnering with Fair Trade USA in different locations in Latin America.

Researchers posed a wide array of questions to find out what resources are required to perform all the activities necessary to establish, grow and manage a hectare of coffee. The results of the initial phase of this study are now ready to be published, with farm-level data from the following four producer organizations: CESMACH in Chiapas, Mexico; ADISA in San Martín, Peru; FCC in Cauca, Colombia; and COMSA in Marcala, Honduras.

After outliers from the interview process were trimmed and general consensus was gained from the resulting field of data, averages were determined to create “benchmark” farmers at each cooperative. The goal of finding a benchmark farmer, says Ben Corey-Moran, director of coffee supply at Fair Trade USA, is to create a local point of reference for farmers and their cooperatives as they work to survive the challenges inherent in the current pricing structure and the global “C” price.

“Using this research, we’ll create a tool that producer organizations can use to build their own economic models based on their local realities, considering local cost of inputs, local cost of labor, and local opportunity costs,” says Corey-Moran.

The resulting estimates were divided into four categories, with “break-even points” to determine financial sustainability. In other words, what price does the average farmer need to earn in order to break even on his or her investment? The four categories of capital investment are variable costs, fixed costs, depreciation costs, and total costs. The final category—total costs— combines the first three, then adds what researchers refer to as amortized establishment costs (opportunity costs of initial investments in equipment) and opportunity costs of land.

“Opportunity costs are the practical consideration a farmer makes to invest time and money in coffee versus another alternative in the region,” says Corey-Moran. Most studies fail to take these costs into account, according to the researchers involved in this study.

For the purposes of this study, it is important to remember that investment can mean both money and time, as farmers often rely on the time of their own families to produce coffee. Therefore, a labor cost listed in the study doesn’t necessarily equate to a cash transaction; rather, it is a valuation of the time invested according to the daily average wage paid in the region.

Siria Velazquez Ramirez (left), 61, and her daughter Amalia Guzman Velazquez, 37, sift sun-drying coffee beans at Siria’s home. The two are members of the CESMACH co-op in Mexico.

Short-Term Implications of the Findings

To illustrate the break-even points, let’s start with the first two categories: variable costs and fixed costs. We’ll use as our example CESMACH, a cooperative of Fair Trade- and organic-certified smallholder producers in Chiapas growing beneath shade.

After surveying 50 farmers, researchers determined that to cover variable costs for a hectare of coffee — which include labor and basic inputs (fertilizers and fungicides, for example) — the average farmer in Chiapas would require about 96 cents per pound of parchment. This equates to $1,127 annually for the average production of 1,172 pounds of parchment per hectare.

Given the sheer multitude of tasks that go into producing a hectare’s worth of coffee every year, the farmers in Chiapas stretch that $1,127 to astonishing lengths. Fertilization, harvesting and processing during the production phase prove cumbersome. Weeding, the practice that ensures nutrients are not leached from the coffee shrub, represents the highest labor cost in the production phase, greater than harvesting and processing costs combined, and requiring more than a month of work throughout the year.

Variable costs is the first of the two categories that represent “cash costs”; to meet these costs, farmers rely heavily on pre-harvest financing. Loans also cover the cost of establishment for some producers.

Land taxes and cooperative fees make up the second investment category: fixed costs. These fixed costs are a much smaller slice of the pie, but are no less urgent than the variable costs farmers need to cover to keep their heads above water from year to year.

“When you think about short-term viability, both variable and fixed costs together are essentially a farm’s annual cost of operation, based on which you can determine a profit margin and stay in business in the short run,” says Colleen Anunu, senior director of coffee supply at Fair Trade USA.

The short-term variable costs have spiked for farmers selling through the CESMACH cooperative in Chiapas. CESMACH manager Sixto Bonilla says farmers in his co-op have had to work especially hard to combat leaf rust during the past few years. Fields with too much humidity run a greater risk of hosting rust, which means farmers in the shade-heavy region of Chiapas must manage overhead trees to promote a healthy amount of aeration.

In spite of the added labor needs of farmers at CESMACH, the study shows these producers are meeting costs for the first two break-even points, rendering them sustainable in the short term.

Longer-Term Implications of the Findings

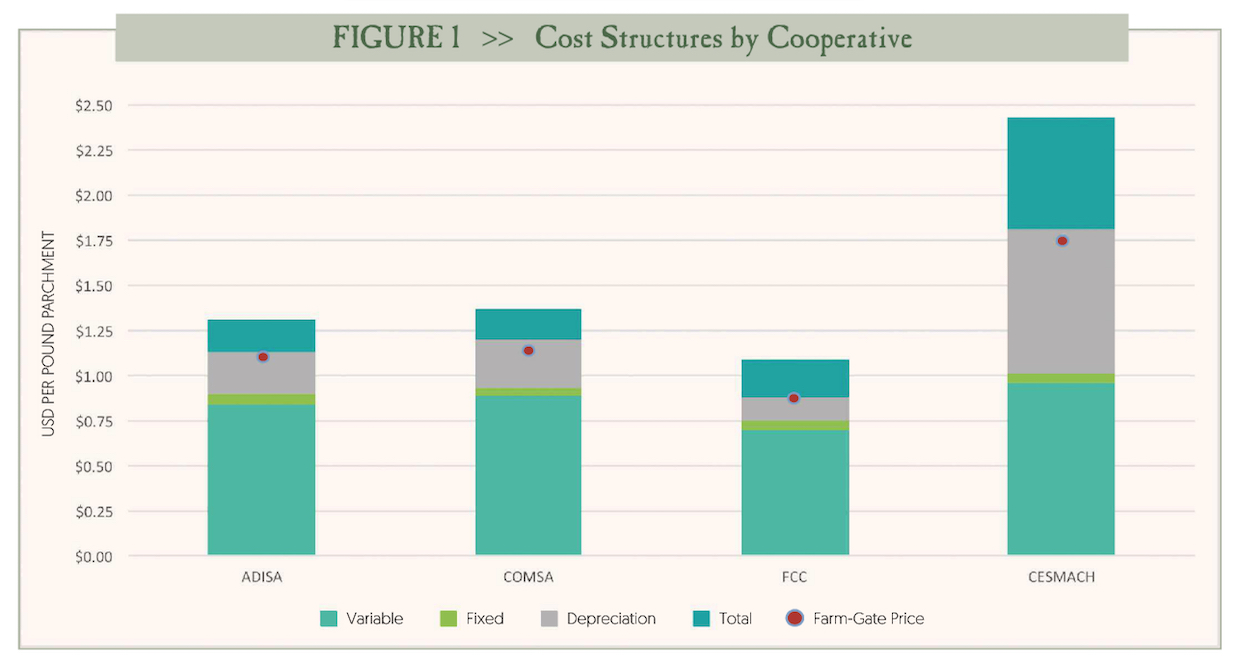

Based on the research methodology, in order to be considered financially sustainable in the long term, the average CESMACH farmer would need to receive a price of $2.43 per pound parchment to break even, with the average total cost of production equaling $2,839 per hectare. In total, the CESMACH farmers surveyed in this study are reporting an average farm-gate price of $1.75 per pound parchment, which will cover just $2,041.37 of the average cost of production per hectare. This means farmers are surpassing the break-even points in the short term, but when it comes to the long term, the benchmark farms at all cooperatives fail to meet the sustainability mark. (See Figure 1, “Cost Structures by Cooperative.”) The data collected for the third category, which factors in depreciation costs, and the fourth category, which builds in additional opportunity costs and amortized establishment costs, support two oft-heard claims from smallholder farmers and their emissaries—that coffee is neither an attractive business nor an economically viable one.

“It’s important to note that these groups used the Fair Trade minimum price, which was above the commodity price, as the basis for negotiations for a significant percentage of their sales,” says Corey-Moran. “While the research didn’t aim to directly test the impacts of Fair Trade — including the minimum price, social and organic premiums, access to finance and other factors — we did see that the minimum price as a starting point allowed farms to cover at least basic costs.”

Nonetheless, while the survey data shows producers are meeting these basic costs, CESMACH manager Sixto Bonilla indicates that remaining financially viable, even in the short term, remains a challenge.

“I think one of the main problems for smallholders is always that, with the land they have and coffee they are producing, they are not able to meet their necessities across the whole year,” Bonilla says, “but if they are organized and gaining certification through the cooperative, they are closer to finding more space in the market for certified coffees.”

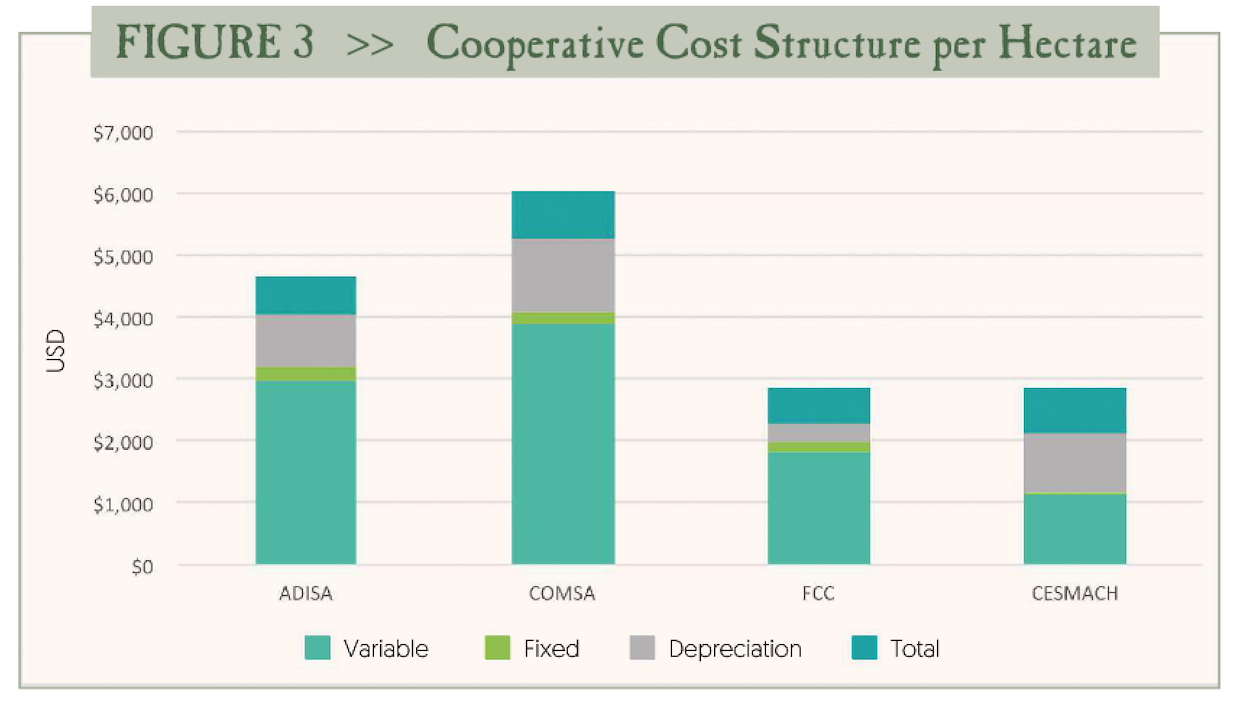

While a higher percentage of contracts based on the Fair Trade minimum offers some protection from price volatility, helping farmers stay solvent in the short term, the medium- and long-term costs loom. Depreciation costs, the third break- even point, are the medium-term expenses a farm can expect to maintain the system of production. For instance, how much will it cost to maintain equipment that will depreciate over time — a new tractor, a new hoe, or a new motor for the farm’s depulper? The average farmer at COMSA in Honduras has 5.39 hectares and might use more equipment than the average farmer at FCC in Colombia, who has only 1.65 hectares. While smallholder farms vary significantly in size and sophistication, researchers determined equipment costs for this study on a per-hectare basis to assign average costs to each benchmark farm.

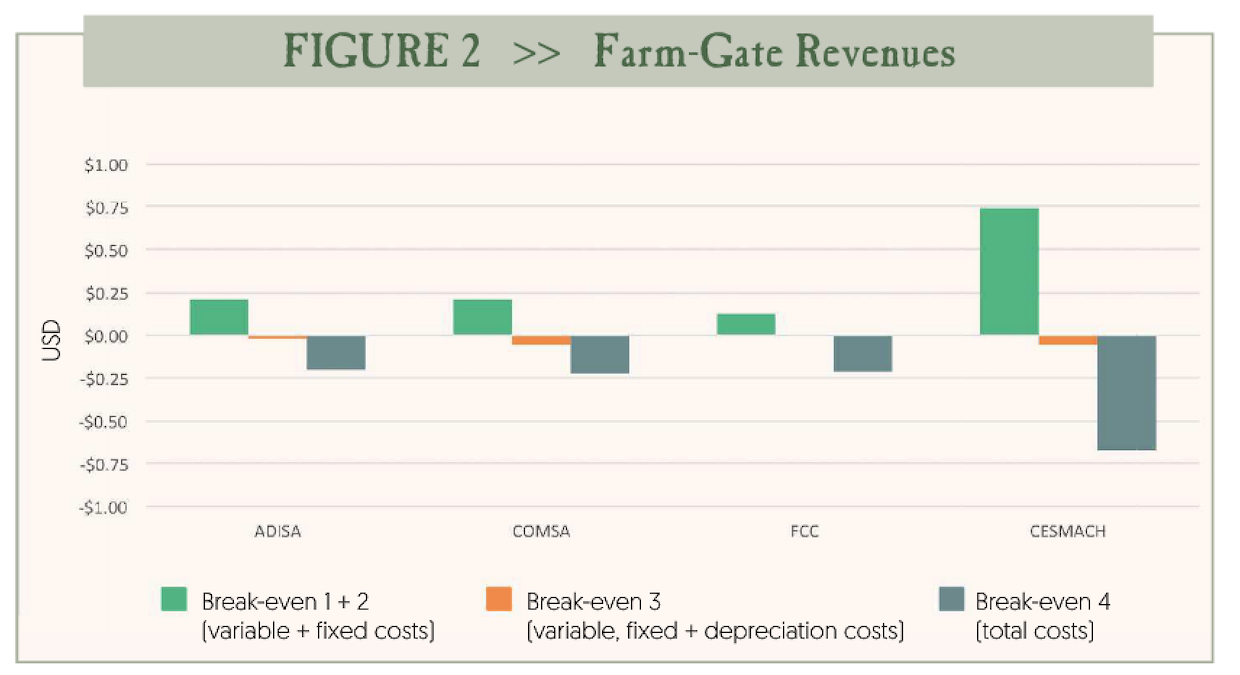

When calculating the average farmgate price per pound for each cooperative, only Colombia’s benchmark farm covered all depreciation costs. Peru would require 2 cents more per pound. Mexico and Honduras benchmarks each would need to make 6 cents more per pound to cover depreciation costs. (To see how each cooperative fared for each break-even point, see Figure 2, “Farm- Gate Revenues.”)

The fourth and final category covers amortized establishment costs — opportunity costs associated with the initial investment in equipment — as well as opportunity costs of land.

For this study, Fair Trade USA and Cornell calculated opportunity costs of land by assessing land value and taking 4 percent of that figure, an accepted standard for similar applied economics research. (The land value for each benchmark farm is an average of the answers producers gave when asked to estimate the value of their land.) By calculating the opportunity costs, the study asks the same question farmers are likely confronted with on an annual basis: If they were to sell their farms and invest the money, or if they rented out their land to sharecroppers or larger agricultural enterprises, would they realize greater profit than they can by producing coffee?

Factoring in opportunity costs, all benchmark farms failed to cover total costs based on the farmgate price. The survey averages show that farmers in Peru, Colombia and Honduras fall short by 20 cents, 21 cents and 23 cents, respectively. Mexico, however, falls short by 68 cents, in large part because of inflated depreciation and additional opportunity costs. With that in mind, CESMACH farmers in Chiapas did relatively well in the short term but could be in a more precarious position than the farmers surveyed in the other three countries in the long term. Farmers at CESMACH may close this gap if they receive more in the way of “second payments” associated with certifications such as Fair Trade and organic. The effect of these second payments, which are received post shipment, will be studied in the next phase of the study. Other metrics for this next phase of research will focus on organizational efficiency of the cooperatives and their ability to access consumer markets.

For now, the inability to meet the thresholds through the farm- gate price, researchers say, is a sufficient explanation for farmer attrition and the subsequent rise in the average age of smallholder farmers.

The Broader Implications

Citing a study published by the International Coffee Organization (ICO) in October 2016, Anunu notes the composite price of coffee, when adjusted for inflation, has not changed in 16 years. This shows little cause to carry on in an industry with a growth potential that might amount to substantial numbers in the aggregate, but means little to individual farmers.

“The research says that prolonged periods of low prices strain liquidity at the farm level, putting the livelihoods of farmers at risk in many countries,” says Anunu. “It also shows the potential for loss of production in the future… When we’re unable to support those that are producing the coffee with adequate revenue, it’s increasingly problematic for [farm] renovation and people’s livelihoods.”

While the prices farmers receive could rise, so could many of the costs that make up the four categories analyzed in the study. This has prompted many to ask an age-old industrial question: How can productivity be increased?

The study puts this question into quantifiable terms, Hernandez- Aguilera points out, through “the sensitivity analysis,” the method to determine the necessary increase in either productivity or farm- gate price to put a benchmark farm in the black. If farmers not only cover the cost but receive some return on investment, they theoretically gain leverage in the market.

Given the average recorded parchment price producers receive at COMSA in Honduras and ADISA in Peru, $1.14 per pound and $1.11 per pound, respectively, producers would have to increase productivity by at least 24 percent in the Honduras pilot and 17 percent in the Peru pilot to be sustainable in the long term. Alternatively, if productivity is stagnant, the price would need to rise by 23 cents per pound at COMSA and 20 cents per pound at ADISA.

“I think there is space to improve productivity,” says Hernandez- Aguilera, “but also there is a limit to given resources and endowments. … [Long-term sustainability] might improve if they receive support that allows them to be more productive in the long term. Then it also depends on the organization; some are more efficient than others.”

At CESMACH, Bonilla says productivity has been improving after a few tough years of managing the most recent rust outbreak, but there is still room for farmers to improve efficiency and not allow activities to fall by the wayside. That, of course, requires more labor, a problematic issue. Farmers relying on hired labor would struggle with even tighter profit margins, which might not have an immediate impact, but would threaten financial sustainability in the medium term. This assumes that variable costs remain stable.

Bonilla estimates (and the study’s labor cost figure confirms) farm workers in southern Mexico can expect to earn only the going rate for manual labor in the region — 100 pesos (about $5) for an 8-hour work day — but in spite of the meager compensation, labor costs still represent a significant portion of the farmers’ financial investment. Considering the compound problem of low wages and labor scarcity amid the rising demand for labor, one could see the industry turning to alternatives to manual labor rather than acquiescing to the demand for higher wages in the field.

“If we can’t afford to pay workers a wage competitive with other industries, eventually, people will stop wanting to pick coffee,” says Kim Elena Ionescu, chief sustainability officer for the Specialty Coffee Association. “… To remain competitive, [farmers] will choose to pay more for hand labor, or they’ll mechanize.”

Ionescu goes on to say that “intermediate mechanization techniques” might be adopted by farms located on suitable topography and with the means to invest in new technology. Given the steep terrain in the Andes and parts of Mexico and Honduras, mechanization might not be viable on the scale seen in Brazil, but a type of mechanized harvester that can harvest efficiently without too much waste, Ionescu says, is being discussed in the industry.

A producer member of the COMSA co-op makes calculations to fill out a questionnaire for the Cost of Sustainable Production study.

Alternatively, to cut labor costs small farmers could opt to send their cherry for centralized processing, as they do at COMSA in Honduras. In Honduras and Peru, variable costs (labor and inputs, combined) are around 65 percent of the total cost. Honduras, however, allocates most of the cost to inputs, whereas Peru’s benchmark farm spends more than half of its variable costs on labor, given that a large majority of producers process on the farm and deliver in parchment.

Hernandez-Aguilera says COMSA’s method of cutting labor costs by delivering cherry to the co-op in Honduras provides an interesting difference for data analysis.

“You are not taking into account pulping, processing,” he says. “That’s very interesting because you can compare the break- even costs for farmers providing cherry versus those providing parchment.”

Whatever the distribution of costs within each category, the tightrope smallholder farmers walk to balance productivity, costs and liquid capital under a stern price suggests a resourcefulness perhaps unfamiliar to many businesses in the United States. At the same time, there are complex concerns associated with a production system in which labor might not be on the books, concerns that do not necessarily show up in the study’s baseline data. For example, when farmers rely on family labor to cut cash costs in the variable category, keeping children out of school to supply that labor can negatively affect the ability of future generations to adapt new technologies and improve productivity.

“When we’re squeezing the supply base where it counts, in their pocketbook, this obviously points to a number of issues,” Anunu says. That includes “whether or not income is being shared in the household,” she adds, “contributing to inequities between men and women as well as farmworkers.”

A New Generation of Conversations

While the research shows that average farmgate prices reported in the survey are not sustainable in the long term, Fair Trade USA and Cornell have taken an initial step in giving the wider industry a better understanding of smallholder farmer costs by the pound, the hectare, and the labor hour.

In phase two of this study, researchers plan to move beyond the farm level and find out what it costs to run a successful cooperative, and the resulting economic benefits producer organizations provide to their membership beyond farm-gate price, in the form of second payment distributions related to business surplus and premiums. For now, Corey-Moran notes that the gamble and guesswork of coffee farming in the face of a global “C” price that can be as precarious as it is austere has for too long decided the fate of the smallholder farmer.

“There has been a lot of mythology or assumptions around the idea that if farmers could just increase their productivity they’d be better off, more sustainable, or if they could just improve quality, they could get a better price and be better off,” he says. “A lot of these ideas have informed national and international policy, company buying practices and investment and development in substantial ways. … This research starts to get in a real way at the farmer’s lived experience and the choices a farmer makes. It opens the door for perhaps a new generation of conversations and what sustainability starts to look like from a farmer’s perspective.”

Jimmy Sherfey

Jimmy Sherfey is a freelance journalist and licensed Q-grader interested in specialty coffee production and the triple bottom line of sustainability. His blog, abeja.coffee, studies the ongoing struggle of good coffee and how strong, transparent relationships between producer and roaster can help. Find him at one of the many new, quality cafes of Orlando, Florida.

As a roaster I’m trying to interpret this article to my own business and the coffee growers I work with.

If I want to compare these prices (paid to a cooperative) to the prices a coffee grower receives if he’s not part of a cooperative, what margin do I need to take into account? If these are prices paid to the cooparative, how much does the coffee grower get?

Where can I find results of phase 2 of this study?