In the early weeks of the COVID-19 pandemic, it became clear that sheltering in place and social distancing created a range of retail market disruptions, and that these disruptions caused a host of supply chain issues and uncertainties. Those immediate challenges are now compounded by real concerns about a prolonged global recession.

In the wake of these accumulating challenges, it is important to consider the longer-term implications of the COVID-19 pandemic for specialty coffee supply chains. One way to do this is to document the evolving sourcing plans and priorities of roasters.

In the first two weeks of May, we sent a survey to 64 specialty coffee roasters that are Specialty Coffee Transaction Guide data donors, that register coffees on the Transparent Trade Coffee website, or that signed this transparency pledge. The aim of the survey is to link the retail disruptions that roasters are facing to planned changes in green coffee sourcing plans and priorities. While the sample is skewed toward progressive “direct trade” roasters, it is enlightening to learn how these thoughtful companies are planning to respond to the many direct and indirect challenges posed by COVID-19.

In the end, we received responses from 37 roasters, for a 58% survey response rate. Twenty of the respondents are based in North America, 13 are based in Europe and four work in other countries.

Overall, most respondents reported experiencing multiple retail disruptions that will precipitate changes to sourcing plans, thereby darkening the outlook for coffee producers, particularly within the specialty coffee market.

Retail Disruptions

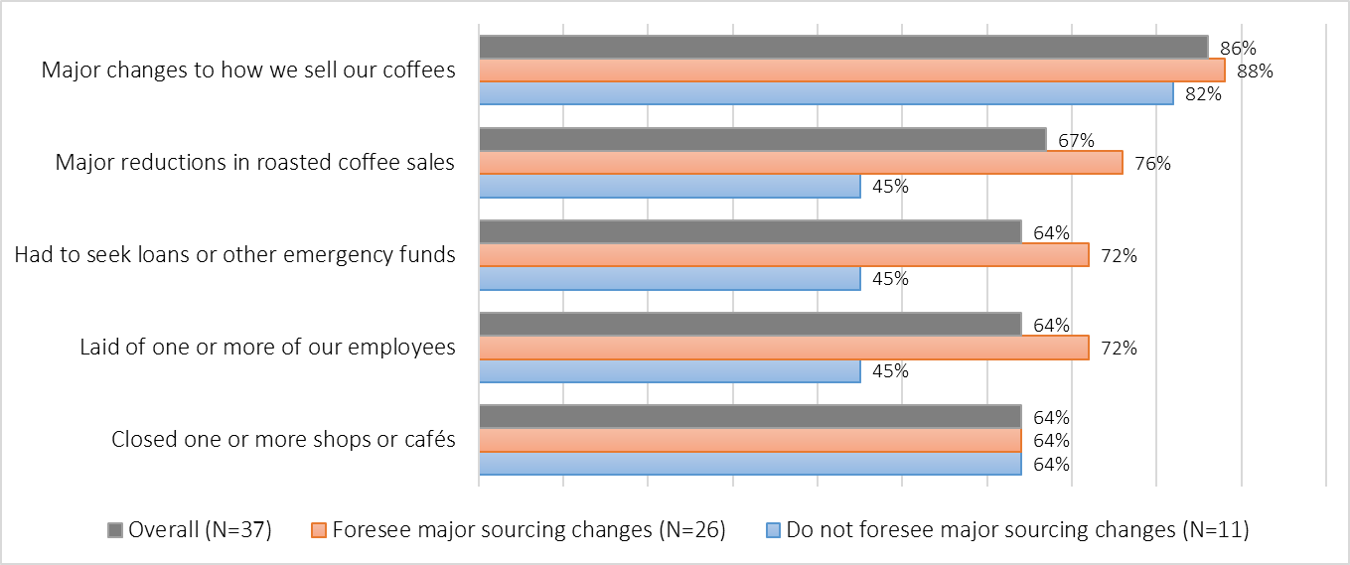

Most of the retail disruptions that have been documented in the press are widespread in this sample (see Chart 1). Almost 90% of the roasters confirm major changes in the composition of sales across the various retail channels, i.e., less in-store sales, but more online or grocery store sales. Roughly two-thirds of respondents report major reductions in total sales volumes, the need for loans and other emergency funds, employee layoffs, or coffee shop closures. Moreover, multiple disruptions are occurring at the same time. The average roaster in the sample reported 3.4 of these five major disruptions during the first month of the COVID-19 pandemic.

To learn how these retail disruptions might work their way down specialty coffee supply chains, we asked each roaster, “Do you foresee making any major changes in the way you will source/purchase green coffees over the next 12-18 months?” On a more positive note, 11 roasters (roughly 30%) do not anticipate major changes. These pockets of stability offer a modicum of comfort for coffee producers that work with these roasters.

However, 26 out of 37 companies foresee major changes to how they source green coffees. Not surprisingly, roasters facing more retail disruptions are more likely to consider major sourcing changes. Those reporting major sourcing changes report an average of 3.7 retail disruptions, compared to 2.8 disruptions for the other 11 roasters. Looking more closely, the disruptions most associated with major sourcing changes are declining sales, employee layoffs, and the need for loans or emergency funds.

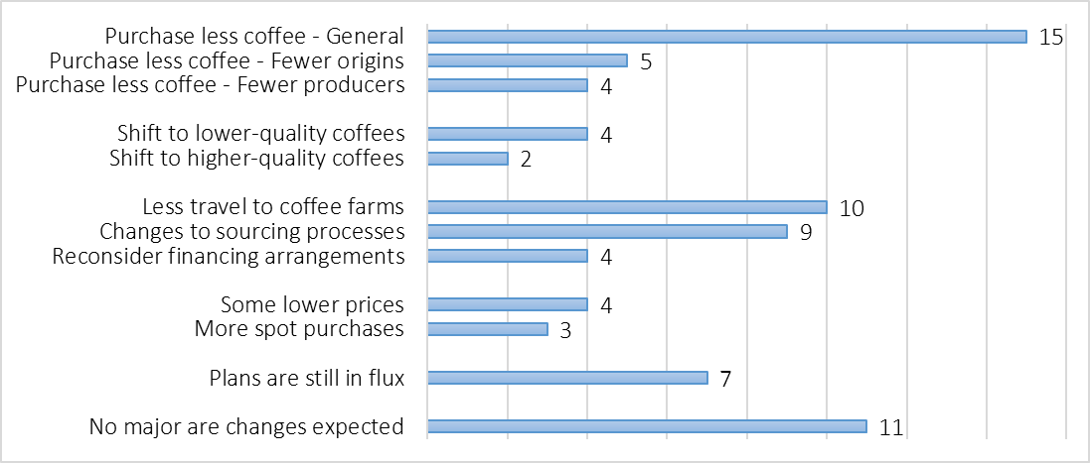

An important issue for specialty coffee producers relates to the specific form that these major sourcing changes will take. We analyzed 80 open-ended responses to the question, “Can you briefly describe up to five of the biggest changes that you expect to make to your sourcing priorities or practices?” (see Chart 2).

Roughly half of the roasters reported plans to reduce the amount of green coffee that they purchase, which is consistent with declining retail sales volumes and tighter financial positions.

‘Direct Trade’ Disruption

In addition to across-the-board volume reductions, some roasters plan to reduce the number of producers that they work with. For instance, several roasters are thinking about suspending purchases from new producers so they can buy as much coffee as possible from existing partners. Others are managing the origins that they engage. In a worst-case scenario, one plans to exclude certain origins from their portfolio.

The second most common change relates to origin travel. Seis Cielo Coffee (Penticton, British Columbia, Canada) is one of ten responding roasters that “will not be able to travel to various locations to cup and select their coffees.” Farm visits are foundational sourcing practices for direct trade roasters and their suspension will add an element of uncertainty for producers that want to make or confirm quality claims in person.

Producers and roasters must also contend with changes to other core sourcing processes, all of which reduce the efficacy and/or increase the cost of the selling process. For example, Seven Seeds Coffee Roasters (Melbourne, Australia) typically does quality control at the milling stage in-country at two of its origin sources, something that will not happen this year. For their committed purchases, Rumble Coffee Roasters (Melbourne, Australia) is thinking about “holding more coffee in country to address possible importing issues.” Finally, Elephant Beans (Freiburg, Germany) is one of several roasters worried that the pre-harvest financing support that they offer is becoming a lot riskier.

Short-Term Challenges

Taken together, several of the survey responses foreshadow challenges for the short-term evolution of the specialty coffee sector, and for producers trying to enter the more lucrative quality segment.

Four roasters noted the possibility of not increasing or delaying price premiums as incentives for quality. In addition, there is a troubling shift in the composition of demand as four roasters report moves away from higher-quality coffees in favor of lower-end offerings.

Wonderstate Coffee (formerly Kickapoo Coffee in Viroqua, Wisconsin) is one of four roasters who will be “more conservative with [their] higher end purchases.” Three roasters plan to substitute more spot purchases to address serious revenue and cost pressures. As more roasters move away from the high-quality coffees, producer investments in these coffees become vulnerable.

Making matters worse, canceled origin trips limit critical access points for producers who seek to differentiate their coffees by engaging directly with specialty coffee buyers. The prospects are doubly bad for market connections that have not yet become reliable, as roasters increasingly hunker down with the producers they know and trust. This makes it harder for other producers to break into the specialty coffee business.

Exacerbating an alarming combination of lower purchase volumes, movements to lower quality and lower prices, and less effective sales processes is the continued uncertainty about what the future will bring. One roaster is still adjusting projections for the next two to three years, while another described an ongoing evaluation of their position based on changing demand.

Sustaining Relationships

While most of the indicators point in a troubling direction, the survey observations are not all bad. Offsetting some of the sourcing challenges and uncertainties are solid supply chain relationships that have developed over many years.

Roasters report that they are more likely to commit to sales and hold sales volumes with these close producer partners. For example, Penstock Coffee (Highland Park, New Jersey) “will continue to source coffee traceably and transparently from the same small set of producers.” More generally, Higher Grounds Trading Co. (Traverse City, Michigan) believes that their long-term relationships will ensure that “we can ride out this tidal wave together.”

There is even a small amount of latent optimism that the mutual adjustments required during these trying times will be good for the longer-term health of supplier-buyer relationships.

Priscilla Soares Roasters (Brazil) believes that “this will make our relationship better as we all are in the same situation, and synergy of working together will bring us closer.”

As the world transitions from short-term shocks into a longer-term recession, many disruptions are flowing from both ends of specialty coffee value chains. We must keep looking for and creating these silver linings — i.e., healthier relationships between producers and roasters — through the many dark clouds associated with COVID-19!

Peter Roberts and Kayla Bellman

Peter Roberts and Kayla Bellman are part of the team that runs the Transparent Trade Coffee program. Peter is the Emory University professor who founded Transparent Trade Coffee and the Specialty Coffee Transaction Guide. Kayla is a graduate of Emory University’s Master’s in Development Practice program, and a long-time Transparent Trade Coffee research assistant.

Thank you for this article. I appreciate the real numbers you provided and not just percentages.